Philosophy

Take advantage of market volatility in order to seek higher returns with lower risk.

Nimble Management

Adapt to evolving environments and through market transitions

Consistency

Design repeatable processes to undertake risks in an effort to achieve optimal and dependable risk adjusted returns

Diversification

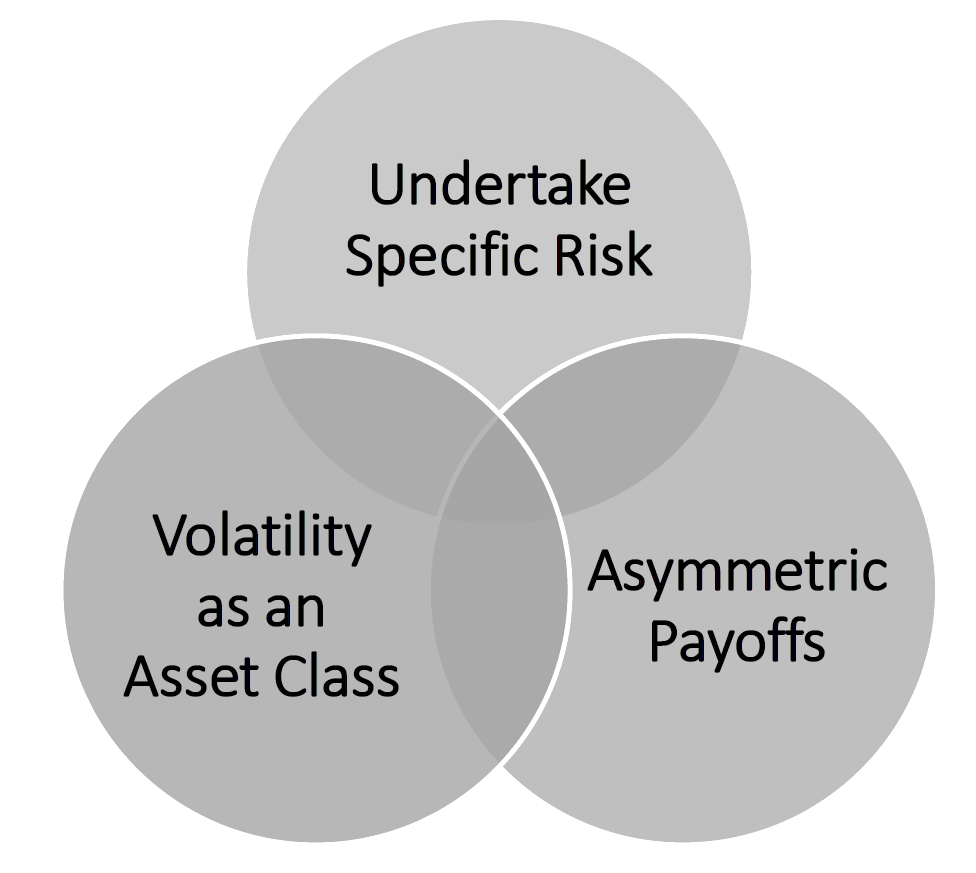

Extract value from markets by undertaking specific risk factors, not necessarily exposure to the asset class

Opportunities in Options

Options introduce the concept of underlying volatility and perception of the underlying distribution as a unique asset class.

Implementing option strategies with repeatable investment and capital management plans designed to profit from specific risk factors in a market.

Option portfolios can isolate exposure. They can be positioned for simultaneous bullish, bearish, movement, and/or no movement over a variety of asset prices and time periods.

Protect capital and reduce exposure without being forced into the risk-on, risk-off paradigm.

Fundamental Ideologies

Mechanical Screening

Utilizing proprietary systems and analytics, we seek to undertake consistent risk adjusted opportunities over a time period.

Expert Risk Discretion

Modeling is a tool that drives informed, probabilistic decision making, but ultimately the human element verifies assumptions and ensures risk mitigation is always at the forefront of generating return.

Capital Allocation

Efficient use of capital across a strategy’s exposure horizon helps diversify the specific risk factor through market environment, sentiment, and time.

Manageability Considerations

If a potential initial investment is not manageable from a risk mitigation perspective, the investment is not made.